Tencent Holdings Ltd (HK:0700) reported robust third-quarter results, surpassing profit expectations primarily due to strong growth across its gaming, advertising, and cloud segments.

Profit attributable to shareholders surged 47% year-over-year to 53.23 billion yuan ($7.37 billion), well above LSEG’s forecast of 46.18 billion yuan. However, revenue came in slightly below estimates, rising 8% to 167.19 billion yuan against an expected 167.82 billion yuan.

Gaming and Advertising Drive Strong Q3 Growth Amid Global Expansion

Gaming remains a cornerstone of Tencent’s business, contributing significantly to its growth. Domestic gaming income rose 14% year-over-year to 37.3 billion yuan, driven by new releases and sustained engagement with popular titles.

The international gaming segment also performed well, with revenue up 11% to 14.5 billion yuan in constant currency, highlighting the company’s ability to expand globally and leverage its gaming portfolio’s “evergreen potential.”

The marketing services segment, previously classified as online advertising, grew 17% to reach 29.99 billion yuan, emerging as one of Tencent’s fastest-growing divisions. This growth reflects strong demand for advertising in Tencent’s ecosystem, especially on Weixin (WeChat), where short videos, mini-programs, and search functions are increasingly popular among advertisers.

Tencent’s results indicate a successful diversification strategy, with promising expansion in advertising and international gaming markets. While revenue growth slightly missed expectations, the profit beat underscores operational efficiencies and resilient demand across its core and emerging segments.

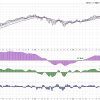

Tencent’s Stock Chart Analysis

Tencent Holdings Ltd (HK:0700) recently saw its share price decline following a period of selling pressure. The 15-minute candlestick chart reveals the stock experienced a steady drop from around 423 HKD to a low of 396 HKD over the last few days. This downtrend could reflect profit-taking by investors or market reactions to broader economic uncertainties, despite Tencent’s strong quarterly earnings report.

In the third quarter, Tencent reported a notable 47% increase in net profit to 53.23 billion yuan, surpassing expectations. Key drivers included strong performance in its gaming and advertising segments. Domestic gaming revenue grew 14%, while international gaming saw an 11% rise, underscoring Tencent’s diverse portfolio and ability to maintain high engagement across markets.

Additionally, the marketing services segment (formerly online advertising) recorded a 17% year-over-year increase, bolstered by demand for short video and mini-program advertising on WeChat.

The recent upward movement from the 396 HKD low could indicate a reversal as buying interest returns around a support level. Investors may view the stock as attractive again after the recent dip, supported by Tencent’s earnings strength. Further upside could be anticipated if the stock maintains support near this level and broader market sentiment stabilizes. However, a break below this support could suggest continued volatility in the near term.

The post Tencent Stock: Q3 Profit Surges 47%, Gaming and Ads Lead appeared first on FinanceBrokerage.