Investing.com — Wall Street is seen trading in a mixed fashion Monday, as investors await the release of earnings from Nvidia, one of the main beneficiaries of this year’s artificial intelligence craze. Bitcoin continued to be in demand, while the Japanese yen slipped lower on increased uncertainty over when the Bank of Japan will next hike interest rates.

1. Nvidia’s Q3 earnings in focus

The main corporate release this week comes from chipmaker Nvidia (NASDAQ:NVDA), a bellwether for this year’s AI craze, which is due to report third quarter earnings after the close on Wednesday.

The results could well be a gauge for investors’ appetite for tech stocks, the AI trade and sentiment for equities broadly, after a post-election market rally stalled.

Nvidia’s chips are seen as the gold standard in the AI-space and its shares have risen around 200% this year, overtaking Apple (NASDAQ:AAPL) to become the world’s largest company by market capitalization.

Analysts see Nvidia increasing third-quarter revenue by more than 80%, to $32.9 billion, but The Information reported on Sunday that the company’s new Blackwell AI chip is said to be having issues with overheating when connected in customized server racks.

The company is working with suppliers to change the design of the racks to alleviate the overheating issue. The AI chip giant has already delayed Blackwell by a quarter due to design flaws that have since been fixed.

2. Futures mixed; key corporate results in spotlight

US stock futures traded in a mixed fashion Monday, at the start of a week that includes several major corporate earnings as well as comments from a series of Fed officials.

By 03:50 ET (08:50 GMT), the Dow futures contract was down 135 points, or 0.3%, while S&P 500 futures gained 8 points, or 0.1%, and Nasdaq 100 futures rose by 145 points, or 0.7%.

The three main indices retreated last week, falling back from the recent highs seen in the wake of Donald Trump’s election win after Fed chief Jerome Powell warned that the US central bank was not “in a hurry” to cut interest rates further.

Nvidia’s earnings will be in the spotlight this week [see above], but there are also results due from the likes of Walmart (NYSE:WMT) and Lowe’s Companies (NYSE:LOW), which will give fresh insights into the strength of consumer spending.

So far, with 93% of S&P 500 companies reporting results, three-quarters of them have reported a positive EPS surprise and 61% have reported a positive revenue surprise, according to data from FactSet.

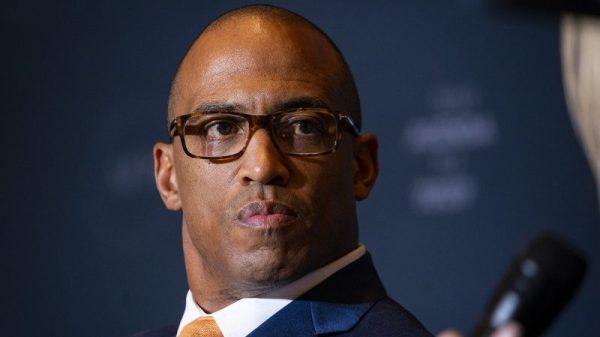

Investors will also get the chance to hear from several Federal Reserve officials, including Chicago Fed President Austan Goolsbee, Kansas Fed President Jeffrey Schmid and Cleveland Fed President Beth Hammack.

3. BoJ remains vague over rate hike timing

The Japanese yen weakened against the US dollar Monday, after Bank of Japan Governor Kazuo Ueda declined to offer specific guidance on the timing of rate hikes.

By 03:50 ET, USD/JPY traded 0.4% higher at 154.88, pulling away from Friday’s low of 153.86 after Japanese Finance Minister Katsunobu Kato warned of possible intervention.

Ueda, speaking directly on monetary policy for the first time since Donald Trump’s victory in the US presidential election, reiterated that interest rates would continue to rise gradually should the economy develop in line with the central bank’s outlook.

However, he made no mention of whether a hike would come in December, disappointing those who thought his speech had been arranged for him to make a policy point.

4. Bitcoin has “a long way to go”

Bitcoin, the world’s most popular digital currency, continued to trade above $90,000 Monday, benefiting from Donald Trump’s election victory and the prospect of an easier regulatory environment.

By 03:50 ET, Bitcoin traded 1.2% higher at $91,996.

The world’s biggest cryptocurrency has become one of the most eye-catching movers in the week since the election, gaining over 30% since Nov. 5, having climbed as high as a record of $93,480.

A one-time crypto skeptic, President-elect Donald Trump has pledged to set up a national Bitcoin reserve and make the U.S. a global hub for the industry.

The cryptocurrency still has “a long way to go”, according to ARK Invest’s Cathie Wood, in an CNBC interview on Nov. 15, who pointed out that Ark was the first public asset manager to gain exposure to Bitcoin in 2015 at $250.

Wood said the continued momentum would be driven by “regulatory relief,” one of the most important things expected from the new United States administration.

“We have a 2030 target in our base case, it’s around $650,000, in our bull case, it’s between $1 million and $1.5 million,” Wood said, reiterating her price prediction over the next five years.

5. Crude hands back earlier gains

Crude prices edged lower Monday, handing back earlier gains after fighting between Russia and Ukraine intensified over the weekend amid continued concerns of a supply glut next year.

By 03:50 ET, the U.S. crude futures (WTI) dropped 0.2% to $66.81 a barrel, while the Brent contract fell 0.1% to $71.03 a barrel.

President Joe Biden’s administration has allowed Ukraine to use US-made weapons to strike deep into Russia, according to reports Sunday, in response to Russia’s deployment of North Korean ground troops to supplement its own forces.

There has been little impact on Russian oil exports from the war so far, but if Ukraine were to target more oil infrastructure that could see oil markets add more of a geopolitical bid.

The benchmark contracts slid more than 3% last week on weak data from China and after the International Energy Agency forecast global oil supply will easily exceed demand in 2025 even if cuts remain in place from a group of top producers.