Investing.com — Baidu’s US-listed shares fell around 3% in premarket trading Thursday after the Chinese internet giant reported a 3% decline in third-quarter revenue, though the figure surpassed analyst expectations.

The company posted revenue of 33.56 billion yuan ($4.64 billion) for the quarter ending September 30, slightly ahead of the 33.43 billion yuan forecasted by analysts polled by LSEG.

Net income rose sharply, climbing 14% to 7.63 billion yuan, significantly exceeding the consensus estimate of 4.67 billion yuan.

Baidu (NASDAQ:BIDU) highlighted a 12% increase in its non-online marketing revenue, which reached $1.1 billion. This growth was primarily fueled by the expansion of its AI-driven cloud computing business.

Baidu is known for its dominance in China’s internet search engine market and its widely used mapping application. It also provides cloud computing services, with online marketing contributing a major share of its overall revenue.

In the AI space, Baidu has positioned its Ernie chatbot as a homegrown rival to OpenAI’s ChatGPT, which remains inaccessible in China. The company recently revealed that Ernie bot now boasts 430 million users.

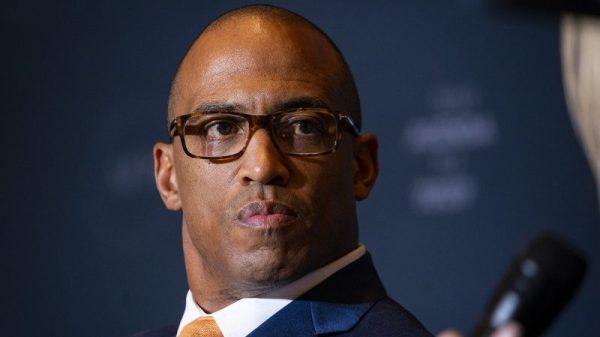

“Baidu Core’s flattish third quarter top line reflected the ongoing weakness in our online marketing business, offset by the growth of our AI Cloud business,” said Robin Li, Co-founder and CEO of Baidu in the earnings press release.

“Despite the near-term pressures, we remain steadfast in our AI-focused strategy and are confident in our long-term trajectory. As we further scale AI, we are emboldened to find how it can drive innovations and create value for consumers, enterprises and society at large.”

This month, Baidu announced plans to launch its Xiaodu AI Glasses in the first half of next year. The smart glasses will feature at least one camera, leverage Ernie’s AI technology, and integrate Baidu’s search and mapping functions.

Although pricing details have not yet been disclosed, the product is anticipated to be a local alternative to Meta (NASDAQ:META)’s popular Ray-Ban smart glasses.