Investing.com — J.P. Morgan’s 2025 U.S. economic outlook outlines two potential paths for the nation’s economy, hinging on the policy environment set by the recently elected administration.

Analysts emphasize that these paths reflect a tension between stimulus-oriented policy changes and the uncertainty surrounding trade and regulation.

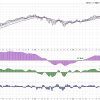

The note flags key economic indicators and forecasts for the year ahead, including GDP growth, unemployment trends, inflation dynamics, and fiscal and monetary policy implications.

J.P. Morgan argues that the recent election, which brought a red-wave administration to power, introduces a dual narrative for 2025.

On one hand, tax cuts and deregulation could invigorate business confidence and productivity, potentially boosting GDP growth while keeping inflation manageable.

On the other, heightened policy uncertainty—driven by tariffs, restrictive immigration measures, and potential geopolitical tensions—might create a stagflationary scenario with weaker growth and elevated inflation risks.

J.P. Morgan projects a moderate slowdown in GDP growth to 2% in 2025, with unemployment expected to rise slightly to 4.5%.

Despite this cooling, the business cycle appears resilient, with labor market tightness gradually easing.

Job growth is predicted to remain subdued, and layoffs are likely to stay low. However, reduced immigration could constrain labor supply and growth in key industries.

Wage growth is also expected to cool further, falling into the low 3% range by the second half of the year. Combined with modest productivity gains, these dynamics suggest that real compensation growth will continue to support consumer spending, albeit at a slower pace.

Core PCE inflation, a key metric for the Federal Reserve, is expected to decelerate to 2.3% by year-end, closer to the Fed’s long-term 2% target. Inflation pressures from tariffs on China, however, could present risks.

A proposed 60% across-the-board tariff on Chinese goods, if implemented, might raise core inflation by 0.2 percentage points, though the broader impact on price stability remains uncertain.

The Federal Reserve is projected to continue easing monetary policy, with incremental rate cuts throughout the year.

By September, the Fed funds target rate is expected to stabilize at 3.5-3.75%, a shift reflecting the Fed’s cautious optimism about managing inflation without undermining employment.

Trade policy looms large in the 2025 outlook. Analysts expect new tariffs on China to disrupt trade flows, reducing U.S. export growth while raising costs for imported goods. Meanwhile, the potential for broader tariff measures—targeting global trade—adds to the uncertainty.

On the fiscal side, the report anticipates a significant expansion in federal deficits. The likely extension of the 2017 Tax Cuts and Jobs Act provisions, alongside increased defense and domestic spending, could push the deficit to 7% of GDP by 2026.

Such levels are concerning in an environment of full employment and muted GDP growth.

Corporate investment is expected to grow modestly, buoyed by consumer demand and federal incentives for specific sectors like infrastructure and technology.

However, analysts note that business spending remains cautious, with companies prioritizing balance sheet health over expansion.

Real consumer spending, a key driver of economic activity, is forecasted to grow at a slightly slower rate of 2% in 2025.

Moderating wage growth, combined with tighter credit conditions and reduced household savings, will likely temper the pace of consumption.