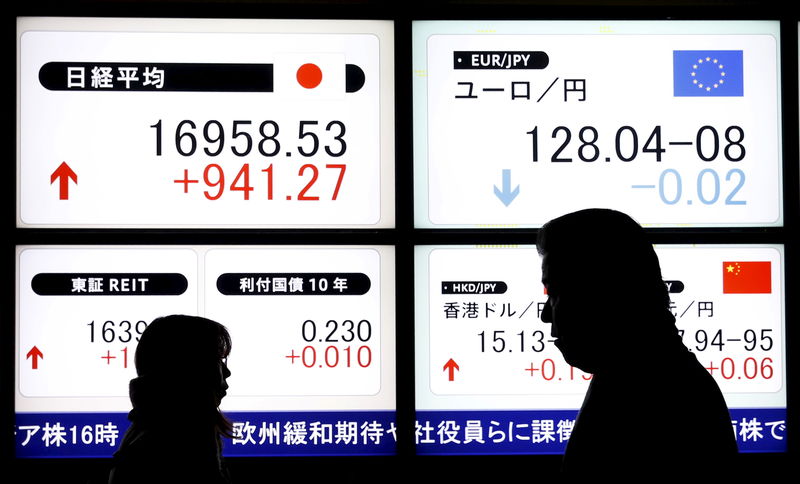

Investing.com– Most Asian stocks declined on Tuesday after U.S. President-elect Donald Trump threatened to impose additional trade tariffs on China and other countries, ramping up fears of a renewed trade war.

Trump said on his Truth Social network that he would impose an additional 10% tariff on goods from China and 25% on all products from Mexico and Canada. This measure was to cut down migrants and illegal drugs flowing across U.S. borders, he claimed.

Stock indexes had gained in the previous session, as sentiment was buoyed by Trump’s nomination of prominent investor Scott Bessent as Treasury Secretary. Bessent is seen holding a much more moderate view on trade tariffs, and considered by investors as a voice for Wall Street in Washington.

Wall Street indexes hit record highs on Monday, while U.S. stock index futures were muted in Asian trade, curbing initial gains after Trump’s tariff threat.

Japan’s Nikkei 225 index declined 1.2%, while the TOPIX lost 1.3%. Both indexes had jumped 1.2%, and 0.7%, respectively, on Monday.

South Korea’s KOSPI was down 0.6%, while Thailand’s SET Index inched 0.2% lower.

Futures for India’s Nifty 50 index pointed to a weak open, as a two-day rally in the Indian benchmark now appeared to be cooling. Focus was also on shares of conglomerate Adani Group, after several of its top executives were accused of bribery and fraud by U.S. authorities.

Australia’s S&P/ASX 200 fell 0.4%, after hitting an all-time-high in the previous session.

Chinese shares positive despite tariff threat

Chinese shares were positive on Tuesday, even as Trump threatened trade tariffs against the country. The Shanghai Shenzhen CSI 300 and Shanghai Composite indexes rose 0.3%, and 0.4%, respectively, while Hong Kong’s Hang Seng index gained 0.6%.

While increased trade tariffs herald more economic headwinds for China, Beijing is also expected to introduce more fiscal stimulus to offset the impact of the tariffs. The country is set to hold two top political meetings in December, where investors will be watching for any more fiscal measures.

UBS analysts said in a Monday note that Chinese fiscal measures were likely to dampen the impact of any potential trade tariffs. Beijing is also expected to impose retaliatory measures against the U.S.

Still, the prospect of a renewed Sino-U.S. trade war heralds more potential disruptions in global trade, which could unsettle China’s export dominance, while also impacting other Asian economies.

BOK rate decision, econ. data on tap this week

South Korea’s central bank is set to decide on interest rates on Wednesday, while November inflation numbers from Japan’s capital city of Tokyo will be released on Friday.

India is set to release its third-quarter GDP report on Friday, while China will release purchasing managers index data on Saturday. Before that, industrial profit data from China is due on Wednesday.

In the U.S., the Federal Reserve’s preferred measure of inflation, the personal consumption expenditures (PCE) price index, is due on Wednesday.