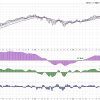

(Reuters) – Europe’s STOXX 600 dipped at the open on Wednesday, with automobile shares yet again feeling the heat from Trump’s proposed trade tariffs, while a sharp fall in French lenders dragged down the country’s benchmark index.

The pan-European STOXX 600 was down 0.2% as of 0825 GMT, after snapping a three-day winning streak on Tuesday.

Investors continue to be worried about the next potential tariff targets after President-elect Donald Trump’s announced big tariff pledges on the United States’ largest trading partners, including Mexico and China.

Following this, European auto stocks fell for the second day, and are among the worst hit sectors, as Trump’s tariffs on Mexican imports to the U.S. is seen bruising the bloc’s car makers.

Among French lenders, Societe Generale (OTC:SCGLY) and BNP Paribas (OTC:BNPQY) fell around 2% each. The risk premium investors demand to hold French debt rose to its highest level since 2012, a sign of investor angst over the fate of the new government and its belt-tightening budget.

France’s benchmark CAC 40 index fell 1%.

U.S. inflation data, due later in the day, is also on investors’ watch list, a day after the Federal Reserve’s November meeting minutes showed officials agreed to avoid giving much guidance on how monetary policy is likely to evolve, considering economic uncertainties.

Among individual stocks, Grifols (BME:GRLS) slumped 7% after a report said that Canadian investment fund Brookfield is considering dropping its plan to take over the Spanish pharmaceutical firm.