Investing.com– The Reserve Bank of New Zealand cut interest rates by 50 basis points on Wednesday and signaled further easing early next year, citing subdued domestic economic activity and waning inflationary pressures.

The RBNZ cut its official by 50 bps to 4.25%, in line with analyst expectations. But some analysts had forecast a bigger, 75 bps cut, given that Wednesday’s decision is the central bank’s final one for 2024.

With an extended three-month gap until its next meeting and the current economic slowdown, the RBNZ was expected by some to act preemptively with another significant rate cut.

“Economic growth is expected to recover during 2025, as lower interest rates encourage investment and other spending. Employment growth is expected to remain weak until mid-2025 and, for some, financial stress will take time to ease,” the central bank said in its policy statement.

The RBNZ began its easing cycle in August, trimming rates by 25 basis points, followed by a sharper 50-basis-point cut in October. With inflation now comfortably within the central bank’s target range of 1-3%, the RBNZ has shifted focus toward stimulating a flagging economy.

Inflation fell to an annual rate of 2.2% in the third quarter of 2024, its lowest in more than three years, driven largely by declining tradable inflation as global supply chains improved and commodity prices moderated. However, domestic price pressures remain sticky, with non-tradable inflation, including surging local authority rates, still elevated.

Meanwhile, economic growth remains sluggish. is forecast to expand by just 0.4% in 2024, reflecting subdued household spending and weaker labor market conditions. Unemployment is expected to rise into early 2025, amplifying concerns over a lackluster recovery.

“Unemployment is expected to continue rising in the near term since the labour market typically takes longer to recover than output,” RBNZ stated.

The central bank reaffirmed its commitment to maintaining price stability while supporting financial stability. It noted that declining import prices and subdued wage growth are consistent with its inflation objectives, creating space for further easing without destabilizing the financial system.

“If economic conditions continue to evolve as projected, the Committee expects to be able to lower the OCR further early next year,” the central bank said in a statement.

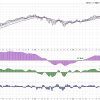

The New Zealand dollar’s pair surged 0.7% after the RBNZ decision.