Investing.com– The S&P 500 index is expected to rise 11% in 2025 on strong earnings growth, Goldman Sachs analysts said in a recent note, although gains are expected to slow after a stellar performance in 2024.

GS expects the S&P 500 to rise 11% to 6,500 points this year, compared to a roughly 25% return in 2024.

A bulk of the index’s returns were driven by five stocks- NVIDIA Corporation (NASDAQ:NVDA), Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Alphabet Inc (NASDAQ:GOOGL), and Broadcom Inc (NASDAQ:AVGO), GS analysts noted, while the equal-weight S&P 500 rose 13% in 2024.

GS also noted that the last time the S&P 500 returned back-to-back annual gains of over 20% was in 1998 and 1999, just before the Dotcom bubble crash.

The index is expected to rise chiefly on improved earnings, with GS forecasting EPS growth of 11% in 2025 and 7% in 2026. The forward price to earnings multiple is also expected to remain unchanged at 21.5 times by end-2025.

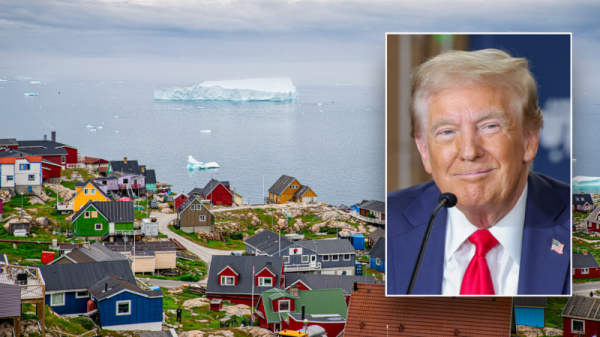

The S&P 500 logged a sluggish start to 2025, extending declines from December as investors locked in some measure of profits from 2024. Uncertainty over U.S. interest rates and policy under incoming President Donald Trump also pressured risk appetite, especially the outlook for local stocks.

The communication services sector was the biggest driver of the S&P 500 in 2024, as heavyweight technology stocks were boosted by hype over artificial intelligence. This trend is expected to somewhat slow in 2025, as investors seek more clarity on just how much AI is factoring into corporate earnings.

The tech-heavy NASDAQ Composite fared better than the S&P 500 in 2024, rising about 29%.