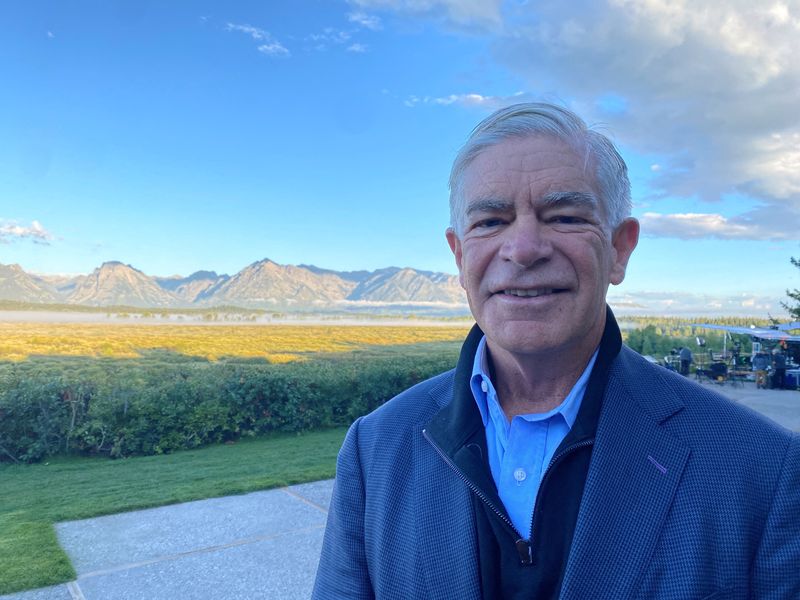

By Michael S. Derby

NEW YORK (Reuters) -Philadelphia Federal Reserve President Patrick Harker said on Thursday he still expects the U.S. central bank to cut interest rates, but added that any sort of imminent move down isn’t needed amid considerable uncertainty over the economic outlook.

“I still see us on a downward policy rate path,” Harker said in a speech to the National Association of Corporate Directors New Jersey Chapter’s Economic Forecast 2025.

“Looking at everything before me now, I am not about to walk off this path or turn around,” he said, adding that “the exact speed I continue to go along this path will be fully dependent upon the incoming data.”

The remarks were Harker’s first since last month’s policy meeting when the Fed cut its benchmark overnight interest rate by a quarter of a percentage point to the 4.25%-4.50% range and trimmed the number of expected rate cuts for 2025, amid forecasts that see higher levels of inflation.

Harker does not have a vote on the central bank’s rate-setting Federal Open Market Committee this year and faces mandatory retirement due to Fed rules. He appeared to oppose any prospect of a rate cut at the central bank’s Jan. 28-29 meeting.

“It’s appropriate for us to take a bit of a pause right now and see how things shake out,” Harker said. “We’re not talking about a long pause potentially, but let’s see how things shake out. There’s a lot of uncertainty,” he noted.

In his remarks, Harker said “the overall underpinnings of our economy remain strong.” But even so, he said, “we remain in very unsettled times” that limit providing guidance about what lies ahead on the policy path. “In an uncertain world, policy needs to remain data-dependent and best positioned to deal with the risks ahead,” Harker said.

He also said “the underpinnings of our macro economy remain strong” and that while inflation remains higher than desired, the Fed has had success in lowering price pressures. But Harker noted that getting inflation back to the central bank’s 2% target is taking longer than expected.

He also said labor markets have stabilized and remain healthy, adding he was concerned by rising signs that lower wage earners are facing higher levels of stress.