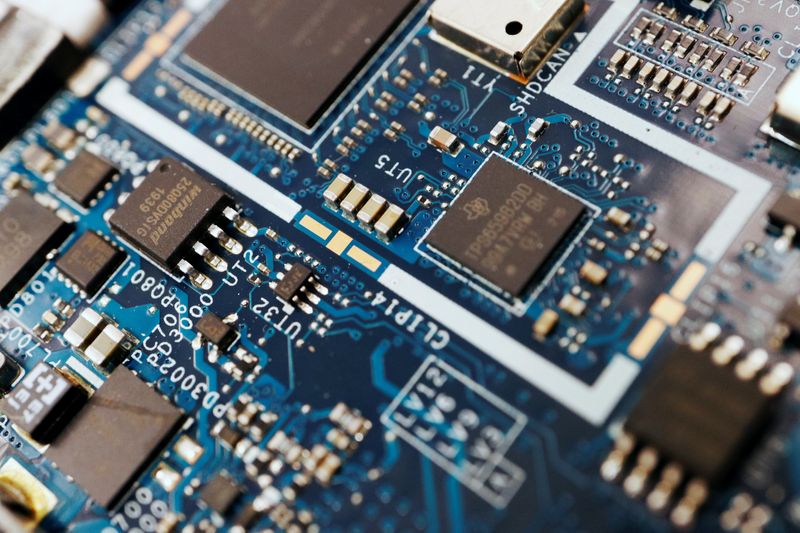

Investing.com – A recent jump in semiconductor stocks is tipped to hit a plateau later this year, according to analysts at Jefferies.

Chipmakers soared in 2024, reflecting a spike in interest in the processors needed to power the data centers that undergird the development of AI. For the year, the sector-wide Philadelphia Semiconductor Index surged by more than 19%.

In particular, shares in Nvidia (NASDAQ:NVDA), whose AI-optimized chips have become synonymous with the hype around the applications of the nascent technology, rose by 171% last year.

Although they expect this increase in semiconductor names to peak in the “March-April” period at around 24% year-over-year growth, the Jefferies analysts led by Janardan Menon argued in a note to clients that the “upside potential for most chip stocks should be modest” in 2025.

“[S]ince demand in major end-markets like PCs, smartphones, general servers, [Internet of Things], consumer electronics and networking is still weak and inventory levels are low, we do not forecast any downcycle this year,” the analysts wrote. “Instead we forecast a plateauing of the semiconductor cycle at healthy double-digit growth for the rest of 2025.”

Price trends in chip shares are expected to “flattish”, the analysts said, adding that the direction of these stocks over the next 12 months will likely depend on how confident investors are in these firms’ outlooks for revenue and earnings growth in 2026.

In terms of specific stocks, the analysts said they prefer Dutch wafer manufacturer ASM to domestic peer ASML (AS:ASML), arguing that ASM is “most geared” to benefit from rising spending on advanced logic chips and has lower exposure to ructions in the Chinese market.

They noted that ASML, “while de-risked for 2025”, needs to achieve 5 billion euros to 6 billion euros worth of orders per quarter to meet 2026 expectations. But this goal may be complicated by major customer Samsung (KS:005930), who has been hit by extra costs as it pushes to supply high-end chips to Nvidia, the analysts said.