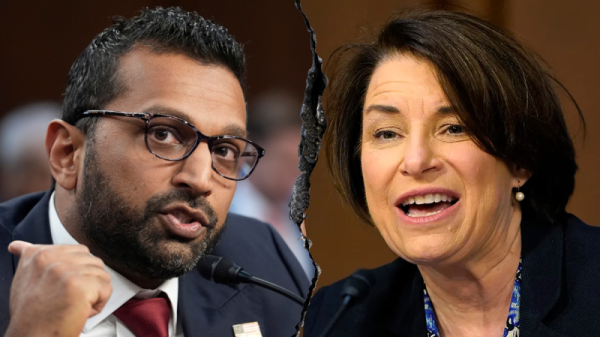

NEW YORK (Reuters) – The United States should keep oversight of potential problems in the U.S. bond market, President-elect Donald Trump’s Treasury Secretary pick Scott Bessent told Congress on Thursday, referring to Wall Street billionaire Howard Lutnick’s plan to clear Treasury futures through a UK firm.

Lutnick’s BGC Group brokerage last year launched a futures exchange and plans to add U.S. Treasury futures in the first quarter this year.

That FMX Futures Exchange has partnered with London Stock Exchange Group (LON:LSEG)’s London Clearing House (LCH), stoking concerns among some U.S. lawmakers that the United States could lose control and oversight of certain Treasury market trades.

With a value of around $28 trillion, the U.S. Treasury market is the world’s biggest bond market and is crucial to the U.S. government’s ability to finance itself, as well as for global financial stability.

During Bessent’s Thursday confirmation hearing, Senator John Cornyn asked him if “a proposal for an entity to clear U.S. Treasury futures at the London Clearing House” could have financial stability repercussions, alluding to FMX.

“Some argue that the Bank of England would have control over a, heaven forbid, a default scenario … in this critical market, instead of the U.S.,” he said.

Bessent said resolution authority over the U.S. Treasury market should remain in the country.

“It is important for the U.S., for U.S. Treasuries, for us to be able to resolve any stress issues in the market in the U.S.,” he said, adding he planned to investigate the issue.

Bessent noted that the bankruptcy of Lehman Brothers in 2008, which caused global markets to plummet, was triggered by issues with its UK subsidiary.

Lutnick is a Trump backer who lost out on the Treasury Secretary role to Bessent but was instead picked to lead Trump’s trade and tariff strategy as head of the Commerce Department.

An FMX spokesperson said the FMX Futures Exchange is fully approved by the Commodity Futures Trading Commission (CFTC), the U.S. derivatives regulator, to list U.S. Treasury futures contracts.

LCH is registered with the CFTC to clear futures contracts, a spokesperson at the London-headquartered company said.

“LCH holds all futures customer collateral in the U.S. onshore, as required by the CFTC for the protection of such funds and assets belonging to U.S. firms,” the spokesperson added in an emailed statement.