By Lewis (JO:LEWJ) Krauskopf

(Reuters) – A look at the day ahead in Asian markets.

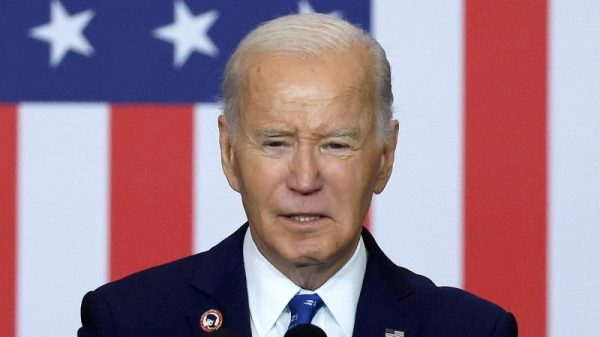

Donald Trump’s vow of hefty tariffs threatened to continue to cloud Asian trading on Wednesday after the U.S. president-elect’s surprise announcements roiled currency markets.

Officials from Mexico, Canada and China warned of broad negative economic consequences after Trump called for a 25% tariff on imports from Canada and Mexico and an additional 10% levy on Chinese goods, until the countries clamped down on illicit drugs and migrants crossing the border.

The reaction in these countries’ currencies against the dollar was swift: China’s yuan fell to its weakest in nearly four months, Canada’s currency hit its lowest in more than four years against the U.S. greenback, while the Mexican peso sank over 2%.

Some of the reaction moderated toward the end of the U.S. session, as investors considered Trump’s salvo potentially part of a negotiating tactic that they were more prepared for after experiencing his first term as U.S. president.

The reaction was also felt in equities, albeit more modestly. China’s blue-chip CSI300 index edged down 0.2%. European indexes also declined, with Europe’s STOXX 600 off 0.6%, while the U.S. benchmark S&P 500 ended with a 0.6% gain.

Some pockets were hit harder, including auto stocks amid fears the tariffs would rattle supply chains. In Europe, Stellantis (NYSE:STLA) shares sank nearly 5%, while Volkswagen (ETR:VOWG_p) dropped more than 2%. In the U.S., General Motors (NYSE:GM) fell 9%.

The day’s action served as a reminder of the volatility Trump could bring to markets, especially with his desire to implement tariffs, a day after his choice of prominent investor Scott Bessent to lead the Treasury Department appeared to calm concerns in the bond market.

Elsewhere, markets will be following the fallout for Adani Group. Two more credit rating agencies cut their outlook for the Indian conglomerate, whose billionaire founder Gautam Adani has been charged by U.S. authorities over an alleged bribery scheme.

Inflation will also be in focus on Wednesday, with the release of the key U.S. personal consumption expenditures price index, a measure followed closely by the Federal Reserve. Minutes released on Tuesday covering the latest Fed meeting showed central bank officials appeared divided over how much farther they may need to cut interest rates.

In other central bank developments, the Reserve Bank of New Zealand was set to give its latest monetary policy decision, with expectations it will lower interest rates by 50 basis points.

Here are key developments that could provide more direction to markets on Wednesday:

– Reserve Bank of New Zealand monetary policy meeting

– Australia CPI (Oct)

– US PCE inflation data (Oct)