FRANKFURT (Reuters) -The European Central Bank should cut interest rates only gradually and not lower them to a level that stimulates growth since that would not resolve the economy’s deep structural faults, ECB board member Isabel Schnabel told Bloomberg.

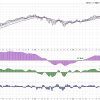

The ECB is expected by investors to cut interest rates at every one of its upcoming meetings at least through next June and the 3.25% deposit rate is now expected to end 2025 at 1.75%, a level low enough – in the view of many economists – to start stimulating growth.

Schnabel, however, appeared to push back on those bets, arguing that central bank stimulus does not resolve structural issues and even squanders valuable policy space for when an economic shock would require speedy ECB action.

“Given the inflation outlook, I think we can gradually move toward neutral if the incoming data continue to confirm our baseline,” Schnabel said, referring to an interest rate level that neither stimulates nor slows growth.

“I would warn against moving too far, that is into accommodative territory. I don’t think that would be appropriate from today’s perspective,” Schnabel said in an interview published on Wednesday.

Some policymakers have called for faster rate cuts and possible stimulus because inflation is falling more quickly than predicted and could undershoot the target, a premise Schnabel also rejected.

“Risks to inflation are now more balanced. But I don’t see a significant risk of an undershoot, in particular one that would warrant a response from our side,” she said.

Schnabel added that she did not see a recession in the euro zone and said there were some signs of a consumption-led recovery, which could underpin the bank’s narrative for a modest recovery.